Nasdaq Crypto Index explained in depth—unpacking how the NCI is constructed, why it anchors institutional products, and what makes its quarterly rebalances so closely watched. Moreover, this guide examines asset-selection rules, weighting caps, governance safeguards, and practical use-cases—thereby giving investors and developers the context they need to rely on the index with confidence.

1. What Is the Nasdaq Crypto Index?

First and foremost, the Nasdaq Crypto Index (ticker NCI) measures the performance of a broad slice of the digital-asset market. Launched on 2 February 2021, it publishes a real-time reference price as well as a once-daily settlement version, thus serving both intraday traders and derivatives desks. Nasdaq Global Index Watch

2. Methodology at a Glance

| Step | Key Rule | Source |

|---|---|---|

| Universe | Asset must trade on ≥ 2 vetted core exchanges and be held by ≥ 1 qualified custodian | Nasdaq Global Index Watch |

| Eligibility Cut-off | Asset must equal or exceed 0.5 % of the combined free-float market-cap of all eligible coins | Nasdaq Global Index Watch |

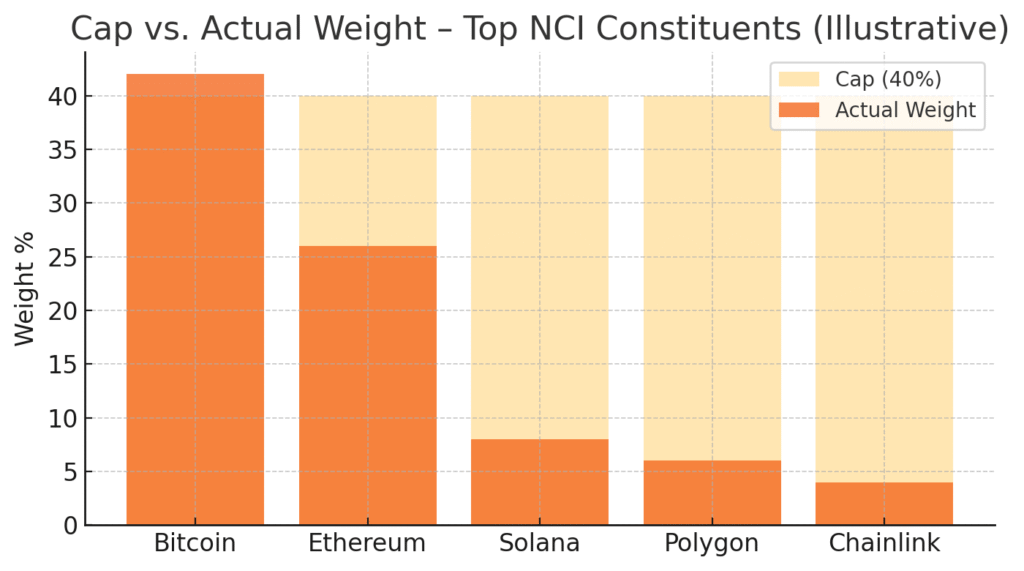

| Weighting | Free-float market-cap with a 40 % cap per coin to curb single-asset dominance | Nasdaq Global Index Watch |

| Rebalance / Reconstitution | First business day of March, June, September & December | Nasdaq Global Index Watch |

| Index Versions | NCI (real-time) and NCIS (daily settlement) | Nasdaq Global Index Watch |

Consequently, the index stays both investible and representative as the market evolves.

3. Constituents & Weights

Chart 1 above visualises an illustrative weight split—showing how Bitcoin and Ethereum still dominate yet, nevertheless, leave room for fast-growing layer-1s and infrastructure tokens. Chart 2 compares the 40 % cap with actual weights for the same assets, thereby highlighting how the methodology reins in concentration risk.

4. Quarterly Rebalance Mechanics

Every quarter, assets falling below the 0.5 % threshold exit, while new qualifiers enter. Because these moves occur on a transparent timetable, market makers can hedge turnover risk, thereby keeping ETF tracking error low. Nasdaq Global Index Watch

5. Governance & Data Integrity

An independent Crypto Index Oversight Committee reviews methodology changes. In addition, Nasdaq audits exchange feeds and custodian partners annually to meet IOSCO benchmark principles; therefore, the NCI’s reference price resists manipulation. Nasdaq Global Index Watch

6. Use-Case Highlights

- ETFs & ETNs. Hashdex’s Nasdaq Crypto Index ETF physically replicates the basket, offering regulated exposure.

- OTC Swaps. Dealers settle forwards against the NCIS daily close, thereby standardising bilateral contracts.

- Asset Allocation. CIOs, meanwhile, slot NCI into multi-asset frameworks beside equity and bond indices to monitor crypto beta.

7. Strengths & Limitations

| Strengths | Limitations |

|---|---|

| Dynamic, rules-based, quarterly reviews | Bitcoin & Ethereum still drive a majority of returns |

| 40 % cap tames single-asset risk | Privacy coins and illiquid tokens are excluded |

| IOSCO-aligned governance boosts trust | Free-float data for newer coins can, at times, be noisy |

8. How NCI Compares

Whereas the CoinMarketCap 100 index refreshes monthly and skews purely by size, the Nasdaq Crypto Index explained here layers stricter liquidity, custody, and concentration rules—therefore better suiting institutional mandates. Likewise, S&P’s Digital Asset Broad Market Index slices the universe into sectors, yet NCI opts for a single, streamlined headline figure.

9. Looking Ahead

Ultimately, Nasdaq plans regional variants (e.g., NCI-US) and ESG overlays that screen energy-intensive assets, thereby aligning with emerging regulation and sustainability goals—and, importantly, expanding the benchmark family for different investor needs.

Key Takeaways

- Nasdaq Crypto Index explained: a free-float, cap-weighted yard-stick with a 40 % ceiling per asset.

- Quarterly rebalances and vetted data feeds underpin institutional confidence.

- Consequently, ETFs, swaps, and multi-asset portfolios lean on NCI as their primary crypto benchmark.

- Finally, understanding the rules helps investors manage tracking risk and seize benchmark-driven flows.